THE ART OF BEING LOCAL

IN MALTA

Company formation in Malta

Setting up a company in Malta is an attractive option for entrepreneurs looking for a dynamic and business-friendly environment. Thanks to its numerous tax treaties and more than 80 double taxation agreements, Malta is a preferred jurisdiction for registering businesses. Furthermore, besides the Maltese language, English is the other official language and the primary language of the trained and professional multilingual workforce in Malta. Malta has benefited from membership in the EU since 2004, which has various advantages.

Establishing a company in Malta provides the best corporate framework for conducting business. The tax environment, legal structure, banking, and general business environment make Malta an attractive location for entrepreneurs and InterGest Malta is the right partner to help foreign companies expand their business internationally.

Interesting information on Malta as a corporate location with Europeanpotential can be found here in a news article.

Besides English the InterGest Malta team speaks several languages, including: Norwegian, Hungarian, German and Swedish.

Chris started his career in London working for several blue chip and FTSE-listed companies which harnessed his strong financial and commercial background. Relocated to Malta in 2008 and worked for international companies that specialised in financial planning and taxation advisory for international clients, high net-worth individuals and entrepreneurs advising on a variety of compliance, corporate, residence and tax issues.

Chris has a strong understanding and knowledge of financial accounting and reporting standards; taxation and compliance matters in a variety of different industries.

He is a chartered certified accountant and holds a Diploma in Fund Administration. He also holds qualifications in Trusts and Estate planning including the use of foundations.

He is a member of the Institute of Financial Services Practitioners (IFSP), the Association of Chartered Certified Accountants (ACCA) and The Society of Trust and Estate Planners (STEP).

After graduating from the University of Oslo, with a law degree specialising in International Tax, Thomas spent some time working as a lawyer for the Royal Norwegian Air Force. Thomas relocated to Malta in 1997 and spent ten years working within the tax and legal department of PwC. He has, over the past years, assisted and advised international and local clients with their tax compliance requirements and on various cross-border issues.

In 2007 Thomas was a co-founder of a boutique multi-disciplinary organisation that advised international clients and high-net-worth individuals on a variety of compliance, corporate, residence and tax issues.

He has extensive experience in advising clients in the setup of complex cross-border structures with the use of Maltese Companies, Trusts, Funds, Partnerships and Foundations. Thomas has a great deal of knowledge about international taxation law, Maltese company law and corporate matters including corporate governance and management and administration affairs.

Thomas is a fellow of the Malta Institute of Taxation (MIM) and a member of the Malta Institute of Financial Services Practitioners (IFSP), the International Bar Association (IBA), the International Fiscal Association (IFA) and the Society of Trust and Estate Practitioners (STEP).

Szabolcs Toth is the Commercial Manager of InterGest Malta. He is graduated as Economist in Business Management and post-graduated as Economics Specialist in Foreign Trade.

Szabi has extensive senior management experience in overseeing business activities in Europe, Middle-East, the Caribbean and South Asia and in the past he accepted various on-site assignments in Africa in the fields of oil&gas, fintech and FMCG. Since 2012 he has been in Malta and has worked in different business sectors, such as ICT, technology consulting, legal advisory and corporate services. As an expat himself, he understands the challenges and the goals of our foreign clients making it easier for our clients to build a successful presence and business in Malta.

WHY SHOULD

COMPANIES

INVEST IN

Malta?

Follow our series

Setting up a company in Malta: advantages entrepreneurs should know about

Strategic location: Malta is strategically located in the heart of the Mediterranean and offers access to various markets in Europe, North Africa and the Middle East. The country's good infrastructure, including a large harbour and an international airport, makes it easier for companies to distribute their products and services internationally.

Pro-business environment: Malta has a stable political and economic environment. The country is a member of the European Union and has adopted the euro as its currency and it can serve as an entry point into the EU. This creates confidence and security for investors seeking long-term business development. The Maltese government promotes entrepreneurship. It offers various incentives and support programmes for start-ups and global players.

No language barrier: Malta is the only official English-speaking EU member part of the Schengen.

Thriving hub: Malta offers a high quality of life for entrepreneurs and their employees. The country has a pleasant climate with many hours of sunshine and a scenic environment. The Maltese culture is rich in history and traditions, which creates an interesting environment for international professionals.

Transparent Legal System: The Maltese legal framework due to its unique heritage combines components of British common law and European civil law which makes it an attractive jurisdiction for corporate structuring, succession planning and carrying out international business.

Favourable tax system: There are numerous tax advantages for companies with trading activities and companies with holding activities based in Malta.

InterGest Malta supports and advises companies with corporate and tax solutions for the establishment of private companies, partnerships, trusts, foundations and other legal entities.

Which legal forms are available in Malta to establish a company?

The Maltese regulatory framework accommodates various entity types, such as public companies, association en participation, Societas Europaea (the "European Company"), Partnership en commandite ("the limited partnership") or Partnership en nom collectif ("the general partnership"), and the most widely used entity type, the private limited liability company.

Malta offers a variety of legal forms that can be chosen according to the individual needs and objectives of the company:

The Private Limited Company (Ltd) can be founded by one or more persons. The liability capital is limited to the nominal value of the shares. The Private Limited Company is a relatively inexpensive and uncomplicated legal form that is often chosen by small and medium-sized companies.

Unlike a private limited company, a public limited company (PLC) has no limit to its liability capital. Shareholders are liable for all their assets. This type of company is often chosen by large companies that are listed on the stock exchange or wish to raise public capital.

An alternative to the Ltd. and PLC is the Limited Partnership (LP). In this legal form, there is at least one partner with limited liability and one partner with unlimited liability. The partners with limited liability are only liable up to the amount of their contributions, while the partners with unlimited liability are liable for their entire assets. This type of company is often chosen by companies that are financed by investors.

Malta offers specific legal forms for certain sectors. For example, there is the "Exempt Company" for international business and the "Holding Company" for companies that act as a holding company. These specific legal forms often offer tax and legal advantages that are utilised by international companies.

Foreigners can register a company in Malta - Setting up a company in Malta is possible for foreigners without any restrictions. There are no restrictions regarding residence or nationality. This makes Malta an attractive destination for international business.

Choosing the right legal form is crucial in order to achieve the desired goals in Malta and run the company successfully. InterGest Malta assesses the individual needs and objectives of companies and ensures that the best legal form is chosen for company formation in Malta. The company is operated by Papilio Services Limited, which is authorised as a corporate service provider and regulated by the Malta Financial Services Authority.

What are the legal framework requirements for forming a company in Malta?

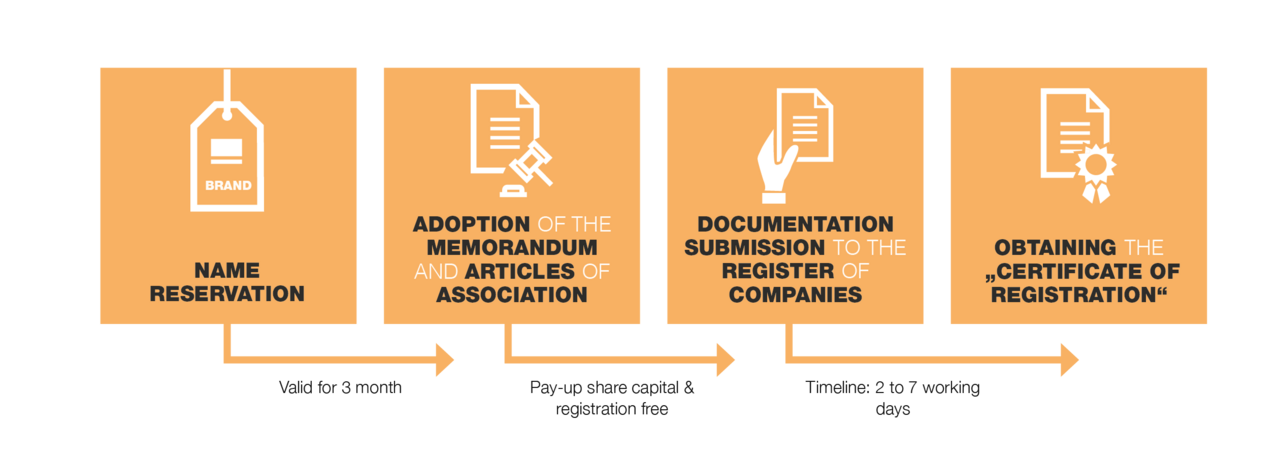

The procedure of registering a business in Malta is quite swift for both public and private enterprises. Typically, the Registrar issues a "Certificate of Incorporation" to the company within 2 to 7 days of receiving all required papers in good order.

Finally, the Registrar should be provided with evidence that the subscribed share capital has been paid up, such as a bank deposit slip, as well as documentation relating to subscribers and directors of the company.

Memorandum of Association - To incorporate a company in Malta, the only essential document needed is a Memorandum of Association. It should include important information like the company name, capital, subscribers, company secretary, and directors. But in addition to the Memorandum of Association, a tailored set of Articles of Association must be filed. The contents of the Memorandum and Articles of Association may differ depending on the type of company. This document regulates the internal management of the company, such as the relationship between members and directors, shareholder rights, and other relevant information.

However, it is important to note that a public company in Malta must obtain authorization from the Registrar before it can legally start its business. This authorisation is needed after the company has received its certificate of registration, and it is a mandatory requirement.Company Name reservation - When choosing a name for your company, you must obtain a reservation that is valid for three months. The Registrar has the power to refuse registration for names that are offensive. Approval is required for every name. A private company's name must end with "private limited company", "limited", or "ltd", while a public company's name must end with "public limited company" or "plc".

The minimum share capital to register a private or public company in Malta - The minimum authorised capital for a private company in Malta is € 1,164.69, and € 46,587.47 for a public company. At least 20% of the issued share capital for a private company and 25% for a public company must be paid upon the signing of the Memorandum of Association.

The number of shareholders required to register a company in Malta - Depending on the type of company, the number of shareholders required varies. A single-member private limited company must have at least one shareholder, while private and public companies must have a minimum of two shareholders. It is important to note that there are no legal requirements for the nationality or residency of a shareholder. It's worth noting that a Maltese company may have only one shareholder.

Management structure requirements - The Memorandum of Association must appoint the first director (who can be a natural or a legal person) of the company. Private limited liability companies must have a minimum of one director, while public companies must have a minimum of two directors. The director of a public company must give written consent to such appointment. The Memorandum of Association must also indicate the first company secretary, who must be an individual. The company secretary is an administrative officer with legal functions and responsibilities.

After incorporation, the company must keep registers of members and directors and file an annual return to the Registrar. The Registrar must be notified of any changes made to the company name, the parties involved, or details of shareholders. Failure to notify the Registrar on time may result in penalties.Company registration fee paid to the authorities - The registration fee payable to the Registrar in Malta depends on the authorized share capital of the company. The fee ranges from € 245 to € 2,250 if the authorized share capital is more than € 2,500,000. Additionally, there is a yearly fee payable to the Registry of Companies in Malta. This fee is calculated based on the share capital of the company, with the minimum being € 100 and the maximum being € 1,400.

License requirements to incorporate a company in Malta - In Malta, there is no need for public authority clearance to incorporate a company if the company does not carry out any activities, businesses or services that require a license or are regulated under certain acts such as the Gaming Act, Banking Act, Financial Institutions Act, Investments Services Act, Financial Markets Act, Insurance Business Act, Insurance Intermediaries Act, Retirement Pensions Act, Trusts and Trustees Act, Special Funds Regulation Act, Travel and Tourism Services Act, or The Crowdfunding Service Providers Act.

How advantageous is Malta's tax regime for establishing a company?

The Malta corporate tax system outlines that in general companies that have trading activities are subject to a Malta corporate tax rate of 35% on a worldwide basis. However, through Malta tax laws, you can reduce the rate of corporate tax to an effective rate of 5% (subject to conditions). Additionally, Malta is seen as an attractive jurisdiction for holding companies. This is owing to several taxation benefits including having a full participation exemption regime, which can lead to a parent company achieving 0% tax on the disposal of shares held or dividends received (subject to certain conditions).

EU-Malta Tax Benefits - As an EU member state Malta is obliged to follow EU legislation which is transposed into local law. A couple of examples include:

The EU Parent-Subsidiary Directive removes tax barriers pertaining to profit sharing amongst EU company groups.

The Interest and Royalties Directive removes the barriers to withholding taxes related to cross-border payments of royalties and interest among affiliated businesses.

Malta Tax Benefits for Individuals - Although the income tax system in Malta is progressive, both foreign nationals and individuals can take advantage of different tax residence programmes.

Malta Tax Residence Programmes - Malta has introduced tax-efficient residence programmes for individuals. These residence programmes give individuals the opportunity to receive a special tax status of 15% (subject to certain conditions).

Malta Global Residence Programme (GRP) – Non-EU/EEA/Swiss nationals

Malta Residence Programme (TRP) – EU/EEA/Swiss nationals

Malta Ordinary Residency

Malta Highly Qualified Persons Rules (HQPR)

Malta Retirement Programmes (MRP)

United Nations Pensions Programme (UNPP)

Investment Services and Insurance Expatriate Residency

Other Maltese Tax Benefits –

In general, no stamp duties or withholding taxes on dividends or profits distributed to shareholders;

Malta has over 80 double-taxation agreements with nations worldwide;

There are no wealth taxes or inheritance taxes;

Malta's VAT rate - In Malta, conventional VAT rates of 18% are applied to goods and services. Some products and services, however, have a lower rate of 7%, 5%, or 0%.

A step-by-step approach to registering a company in Malta.

Research the Maltese market: Before setting up your company in Malta, it is important to research the market and the business opportunities there. Find out about the economic conditions, the industries that are successful in Malta and the current trends. Talk to InterGest Malta and get expert advice right from the start.

Choose a suitable legal form: There are various legal forms to choose from in Malta. Consider the specific needs of your company and choose the appropriate legal form.

Create a business plan: A solid business plan is the key to success when setting up a company in Malta. Define your business goals and strategies, analyse the market and your competition and prepare a financial forecast. A well-thought-out business plan is also crucial when applying for funding.

Register your company: Once you have chosen a legal form and prepared a business plan, you must register your company with the Maltese authorities. This includes registering the trading name and submitting the necessary documents, such as the articles of association.

Obtain a tax number: apply for this at the Maltese tax office and make sure that you fulfil all your tax obligations.

Submit a corporate bank account: The company can do legitimate business in Malta using either an international or a local bank account. Alternatively, an Online Payment Service Provider (PSP) is an option too.

Apply for the necessary licences if applicable: Find out about the specific requirements of your industry and make sure you apply for all the necessary licences.

Employee recruitment: Once your company is incorporated in Malta, you can hire employees to support your business. Be aware of Maltese labour laws and make sure you have the necessary contracts and insurance in place.

What are the next steps after registering a company in Malta?

Acquire a License for Your Business - All the information required for business licensing is available from the Department of Commerce. For most firms, getting a license just means filling out a form detailing what the company performs. The type of business being founded is one of the aspects that can impact licensing fees, therefore you must apply for additional licenses in accordance with the appropriate legislation.

VAT registration - Depending on whether an economic supply qualifies as a VAT supply, a Malta business performing the supply most probably would need to be registered for VAT with the VAT department in Malta. Additionally, a wide range of supplies are classified as exempt supplies, for which registration may or may not be required. It's critical to know which category your company's supplies are in.

PE number registration - Employment requires a PE Number. In order to work as a self-employed person or as an employer, registration is required.

Tax Identification Number (TIN) - You can get a Tax Identification Number (TIN) with our assistance. After obtaining a TIN, self-employed persons must file personal self-assessment returns and corporate firm owners must file annual tax filings. It is highly advised that professional assistance be obtained when filing taxes to prevent any mistakes—especially if accounting is not your area of expertise. In addition to ensuring that your tax return is appropriately filed, as experienced advisors we will also inform you of any taxable deductions, allowable expenses, and financial incentives that your company may qualify for.

Accounting - To stay compliant, Maltese businesses need to follow stringent accounting guidelines. For this reason, our team of knowledgeable experts is available to help your company with all of its accounting requirements. We offer a comprehensive range of services, including advice on revenue and expenditure transactions as well as the creation of balance sheets and profit and loss statements.

Back-office business support - Back-office services are essential to operating a profitable and successful business in Malta. Every organization's successful operation depends on these non-specialized administrative activities, which just need dedication and attention to detail to be completed with high performance and professionalism levels.

Registered office - We provide our clients access to registered office premises in Malta so they can continue to comply with local laws. We recognize how critical it is to comply with these regulations and how important it is for businesses to keep overhead costs to a minimum. Both goals can be achieved with the assistance of our offices when registering your business.

Expert advice on setting up a company in Malta

When setting up a company in Malta, it is crucial to be guided by a competent advisor. At InterGest Malta, experienced specialists will help you manage the legal and bureaucratic aspects of the local incorporation process and ensure that your company is on a solid footing from the outset. You will receive the full range of services for setting up your foreign subsidiary - from payroll, business process outsourcing, accounting, ongoing tax and legal advice, day-to-day fiduciary administration, reporting and controlling. InterGest Malta also provides customised support in many service areas from the company's own network.

The InterGest Malta Offices are situated in the centre of Valletta, the capital city of Malta. Our strategic location and our international team of highly skilled professionals, comprising accountants, lawyers, and tax consultants, put us in an ideal position to assist clients seeking to set up company structures or business operations in Malta.

InterGest Malta is serviced by Papilio Services Limited which is licensed to act as a Company Service Provider and is regulated by the Malta Financial Services Authority.